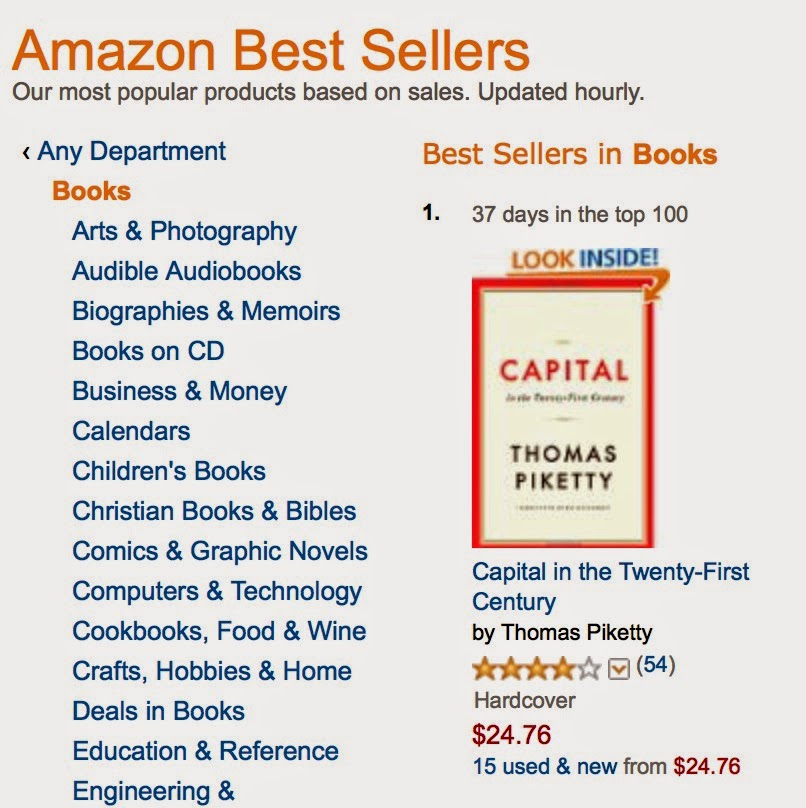

Thomas Pikkety’s book “Capital in the 21st. century” seems to be the must-read of the moment. It is central to the raging discussion about in-equality, and amazingly, the current top seller on Amazon.

However,

it is also 700 pages long.

I’ve

only found a few podcasts with Pikkety:

This

is a 50 minute presentation, which give a good introduction to his core

concepts.

This

is a 40 minute video-interview with Huffington Post:

Among

Pikkety’s main points are that the main factor determining the degree of

in-equality is the ratio of income from capital vs. the overall rate of

economic growth in society.

The

larger the returns on capital are, the more those that have wealth already,

will gain relative to those that get their income from wages.

At

the moment, there is confluence of several trends, which are driving

in-equality to levels that are as bad as in the 1920ies:

Financial

services and stock markets are producing an ever-larger share of all the

economic growth – but mainly to those that have the capital to invest. Automation

and advanced technology makes income from capital intense industries more

important, while labour intensive sectors contribute less. Growth in the economy

that is based on wages is stagnant.

Furthermore,

the demographic trend towards a falling population means that inheritance

becomes more important, since the wealth of a person is divided among fewer

children. Also, lower population growth or declining populations causes lower

overall economic growth in society.

Pikkety

believes the polarization will grow further, and he believes that it is

de-stabilizing. He says that some inequality is good, but beyond a certain point,

it’s simply excessive. The solution he proposes is a sharply progressive tax on

property.

No comments:

Post a Comment